Importance of Financial and Wealth Management for Doctors

M3 India Newsdesk May 07, 2023

Financial & wealth management is crucial for medical professionals to achieve their financial goals & maintain a comfortable lifestyle. The article highlights the impact of financial planning, goal-setting, comprehending investment options, & effectively managing cash flow, debt, risk, & wealth.

Finance - the word itself makes us feel lost. Makes us scratch our heads, feel uneasy, or just numb. We are all running our practices and busy with our daily routines. Why do we even need to know finance or wealth management?

We are so well trained to manage our patients and keep upgrading our clinical skills now and then that we fail to understand that we are lacking in a very important aspect, too. So many times we just want to upgrade ourselves, our practice, or the hospital, or just go on a holiday or a vacation. But when we look back at our account, we just don’t find enough money. Sometimes we are just confused about what should we prioritise in terms of spending. And so many times we have a dilemma about charging our patients too. We see our friends and family members of our age or younger much more settled and earning, saving, and enjoying their earnings. But we don’t understand the difference. It is just because we are not taught how to manage our money.

Being medical professionals, we put in equal or extra effort to study and practice as compared to other professions. So we should learn to manage our wealth and finances to live the life we dream of and enjoy what we do from within. All of us like being rewarded for what we do. And that applies to us doctors too. But for that, we need to understand that there is something called financial and wealth management.

There is inflation every year, and in India, the long-term inflation rate is around 7-7.5%. We need to work on our finances according to the current changes in the financial system. Financial planning is the process of utilising your financial resources in the best possible way to achieve your financial goals.

Why is it so important to learn financial and wealth management?

Because most of us don’t have social security plans like government pensions or have no knowledge about our basic wealth status. We need to bring in a financial discipline.

We need to understand cash flow management, debt management, risk management, and wealth management.

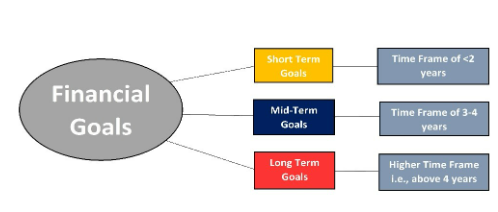

The first thing to be done is set your financial short, medium, and long-term goals in professional and personal areas of life. Make sure you set your goals with the number of years in which you want to achieve them.

There are a lot of investment options like debt funds, bonds, mutual funds, equity, real estate, commodities, fixed deposits, recurring deposits, savings accounts, balance funds, index funds, gold, PPF, etc.

The choice of investment option depends on which financial goal you want to achieve and how much risk you are willing to take to achieve that.

Short/medium-term goals of < 1-3 like upgrading a piece of equipment or children’s education fees, which needs easy liquidity in terms of funds should be planned in a way where the funds are secure yet easily accessible and are growing even in that short of a duration. Starting a monthly saving plan in terms of a SIP can be the best way to do so.

Long-term goals like marriage, child education, retirement, etc. can be planned by investing money in stocks, bonds, mutual funds, real estate, PPF, or even gold/gold bonds.

While managing finances, we should know our liabilities, some of which are fixed like monthly salaries, house expenses, and clinic expenses like utility bills, EMIs, rent, taxes, insurance, etc. We should keep track of these expenses and make sure we have them checked regularly.

A few things like health insurance, indemnity, term plans, property insurance, etc are also a crucial part of our lives and shouldn’t be ignored.

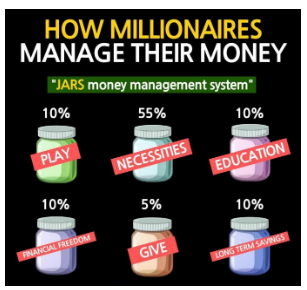

All the surplus money should be managed well by segregating it into different sections. This easy method can be followed to make sure you can enjoy each area of your life by distributing your wealth in different accounts or jars every month.

You can make six sections or jars for different purposes

1. FFA (Financial freedom account)- 10% of your monthly income should go here; do not spend this money.

2. LTSS (Long-term savings for spending account)- 10% of your monthly income should go here; this is for long-term goals like vacations, dream homes, etc.

3. Education account- 10% should go here; to grow, you need to upgrade and update in all walks of life and not just your profession.

4. Necessities account- 55% should go here; to take care of your monthly necessities.

5. Play account- 10% should go here; spend every month on yourself to pamper yourself. You deserve that as you work so hard and rewards make you happier and keep you motivated.

6. Give account- 5% should go here; you need to give back to society in terms of charity from what you earn. Only then the money grows. This is the minimum amount you should do for charity.

Managing money in such a methodical way will help us enjoy money in all walks of life.

If we still are unsure how to go about it, there are courses where we can learn and start doing it or there are financial planners who can guide us through what needs to be exactly done and how.

Make sure you are enjoying and loving the money you are earning with a positive mindset.

Disclaimer- The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of M3 India.

About the author of this article: Dr Ridima Surve is a medical writer, editor and reviewer from Mumbai.

-

Exclusive Write-ups & Webinars by KOLs

-

Daily Quiz by specialty

-

Paid Market Research Surveys

-

Case discussions, News & Journals' summaries