Financial planning and investment tips for doctors: Dr Purvish Parikh

M3 India Newsdesk Apr 14, 2022

Financial planning and investments have always ensured a secured life. Dr Purvish Parikh has put forth an article based on his personal experience that includes the most important financial instruments for doctors and the best investment avenues that doctors can consider, and may serve as a second source of income.

As a full-time faculty at a busy government teaching hospital, I remember being busy with patient management from 7 am till late after sundown. By the time I reached home, I was totally exhausted and only managed a hasty dinner before crashing for the night. I did not have time to think even about professional development – the only attention to finances was to ensure that the salary was credited to my bank account in time.

Little did I realise that failure to do financial planning was the biggest mistake of my life. Enlightenment occurred only after I retired, something that I hope and pray no other doctor would fall prey to.

So let me share my thoughts on how all doctors (and other healthcare professionals) should earmark dedicated time for financial planning as early as possible in their professional careers.

1. Don’t let your money become lazy!

Every day your money lies in a savings bank account or is placed in fixed deposits, you are losing money! Taxable interest on your money reduces the returns significantly (assuming you are in the tax bracket where income from interest is taxable), and it shall always remain below the rate of inflation. Hence it is absolutely necessary to invest money elsewhere (see point 2).

2. Plan together to slice the professional income systematically and stick to the decision

Most financial planners will recommend the allocation of funds to one or more of the following – debt funds, other mutual funds, equity market, commodities like gold and property/ real estate. The common statement is that asset allocation should be based on financial goals.

It is true that we need to plan for specific events that might have significant expenses (like a child’s wedding or admission to a college abroad). After taking those into consideration, the rest of the investment is purely based on the risk that you are willing to take. As a rule of thumb, the higher the returns expected, the higher is the risk that your investment might be lost. Also, some money should be invested in a manner that can be easily and instantly withdrawn for emergency situations (like in short term debt fund schemes).

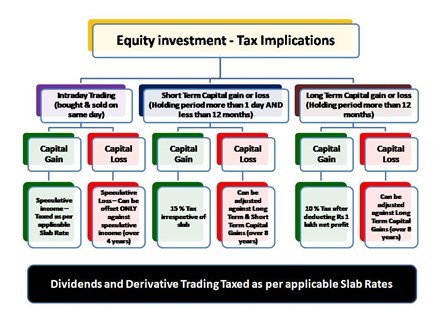

a. Debt mutual funds / Equity mutual funds / mixed mutual funds - The largest chunk of your investment portfolio should be in equity or mutual funds. Such investments are liquid, easily movable from one asset class to another, are visible in a transparent manner online, can be reviewed as often as necessary, and usually give good returns (subject to market risk). There are also the options of SIP (Systematic Investment Plan) and STP (Systematic Transfer Plan) so that market volatility can be averaged out. The longer you remain invested, the greater are likely to be the returns. Also, keep in mind the tax implications when you decide to exit or encash the gains (refer to the figure below).

b. Commodities (especially gold) - Investment in physical gold is the tradition of most Indian families. Sentiment does not allow this to be sold except under especially stressful circumstances. Hence physical gold purchased is usually not considered an investment. If you want to really invest in gold, it should be in the form of gold bonds. RBI issues sovereign gold bonds. The objective of this scheme is to reduce the demand for physical gold and shift this asset into financial savings. It is also possible to invest in gold vial Gold Mutual Funds, Gold EFTs and even Digital Gold.

c. Property - The house/ apartment that you live in should not be considered an investment. Investment in property is generally not recommended. A significant percentage of transactions is still carried out in cash, which cannot be accounted for. Also, the returns are highly variable, usually do not match returns in stock/ mutual funds and the asset is not easily encashed.

3. How much time can you devote and how much interest do you have in handling your finances?

a. If you don’t have the time and interest to pay personal attention regularly, take the help of a professional financial planner/investment adviser and let them be responsible for managing the funds. Make sure there is a three-monthly discussion with them to review performance and corrections if any.

b. If you have some time and limited interest, divide your funds into two components. The larger component should be left in the hands of a professional financial planner/investment adviser. Open a Demat account for dabbling on your own. Several apps are available so that you can manage your investments using your smartphone. Remember that patience is a virtue. I repeat, the longer you remain invested, the greater are likely to be the returns.

4. Tax Implications on Equity Investment

5. Special circumstances - Additional hacks

a. Credit cards - Choose your credit card wisely. Factors to be taken into consideration are whether the card has an annual fee or not, the credit limit permitted, the real value of its reward points program and the value of the annual purchase you will make on the card. It is better to have fewer cards (not more than three).

Do not fall into the EMI trap. Make sure the full amount due is repaid to the credit card well before the due date. Remember the interest rate and penalty charged by credit cards are exorbitant and can kill all the gains that you are making from other investments.

One trick that credit card companies use is to show the “recommended” due date for payment which is well before the actual due date. Also, government regulations have specified that late payments (by up to 3 days) should not incur a penalty – a law which is to our benefit but not well known.

b. Insurance - Insurance should be bought solely for the sake of the insurance. Lots of wealth management professionals encourage the purchase of insurance packaged bundled with some form of return on the premium paid. None of them has any real value. It is better to purchase pure insurance as per requirement (will incur a lower premium) and then invest separately in the asset sector that you are interested in.

c. Hidden charges - Beware of hidden charges. They can be at the time of investing, at the time of moving from one asset class to another as well as during exiting. These hidden charges also change from time to time – investors should be aware of changes in an opaque manner.

6. Fancy yourself as a Shark Tanker?

Doctors are looked upon as successful, intelligent, sincere and at low risk for financial default. This is why most banks are eager to give loans to doctors at attractively low-interest rates. This is also the reason why successful doctors will be often approached for funding of various schemes and businesses.

Disclaimer: These are personal opinions of a doctor who is not a professional financial planner or investment advisor. The comments are based on the doctor’s personal experiences only. These can only serve to make you aware of a few aspects of financial investments and a second source of income. You are advised to take the help of a qualified, trained and experienced professional financial planner or investment advisor before making your own investments. The views and opinions expressed in this article are those of the author's and do not necessarily reflect the official policy or position of M3 India.

The author, Dr. Purvish Parikh is a Precision & Medical Oncologist from Mumbai.

-

Exclusive Write-ups & Webinars by KOLs

-

Daily Quiz by specialty

-

Paid Market Research Surveys

-

Case discussions, News & Journals' summaries